- This event has passed.

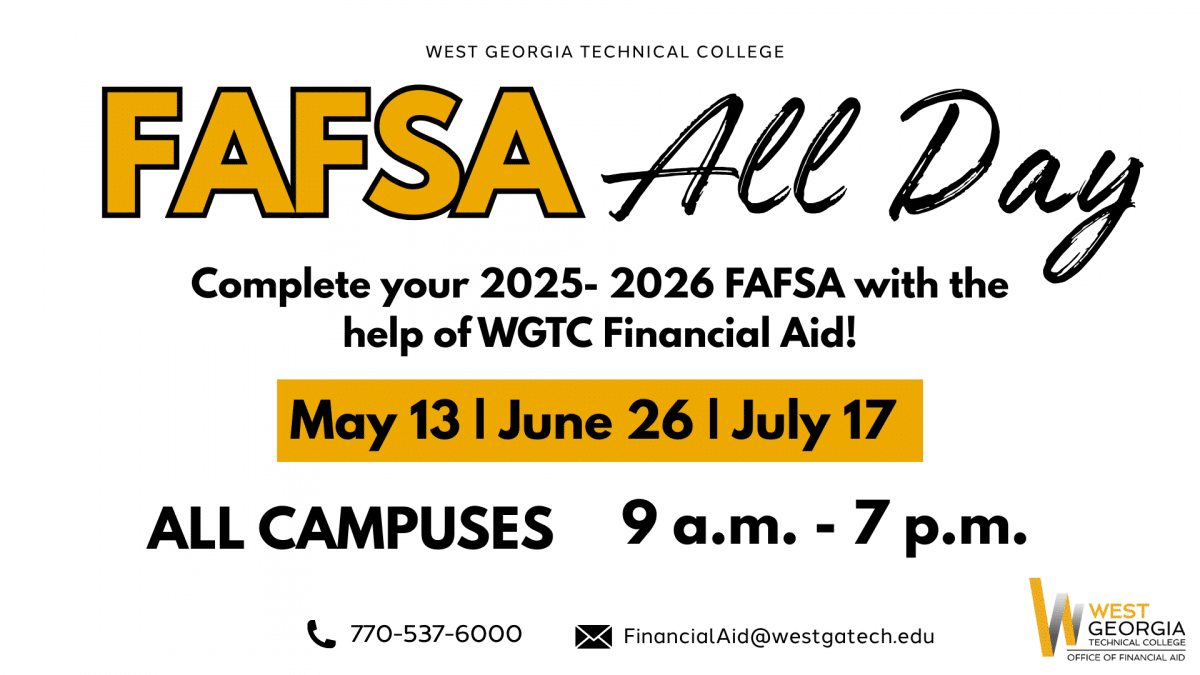

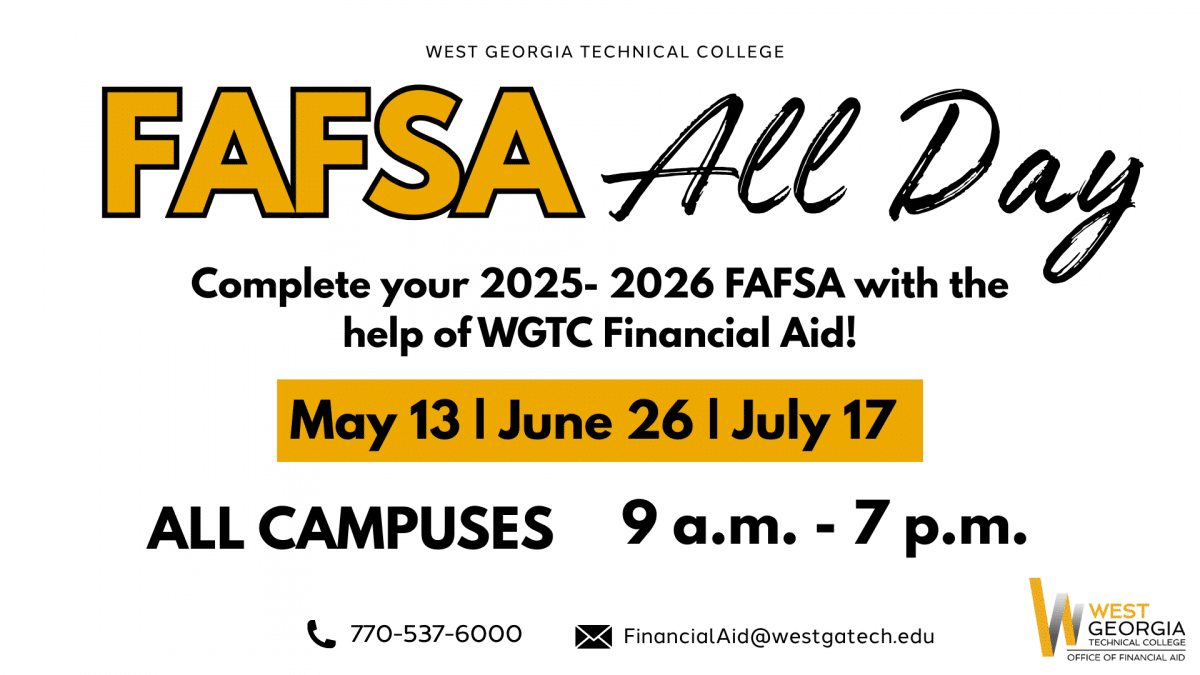

FAFSA All Day

June 26 @ 9:00 am - 7:00 pm

All Campus Locations

To access Okta, Email, Blackboard, and Banner, click MyWGTC Portal.

The training & services provided by WGTC-Economic Development division are on-demand, customized training designed to meet the needs of local industries. Our experienced faculty & staff provide ongoing training & upskilling of workers in order to keep businesses productive and competitive. We also offer many online options for learners that need a more flexible schedule & location.

All Campus Locations